- Home

- Case Studies

- Stocks: Borrowing Against Equities Like the Ultra-Wealthy

Stocks: Borrowing Against Equities Like the Ultra-Wealthy

Use your stock portfolio as collateral to access cash while retaining market exposure.

Strategy Overview

Description of the Use Case

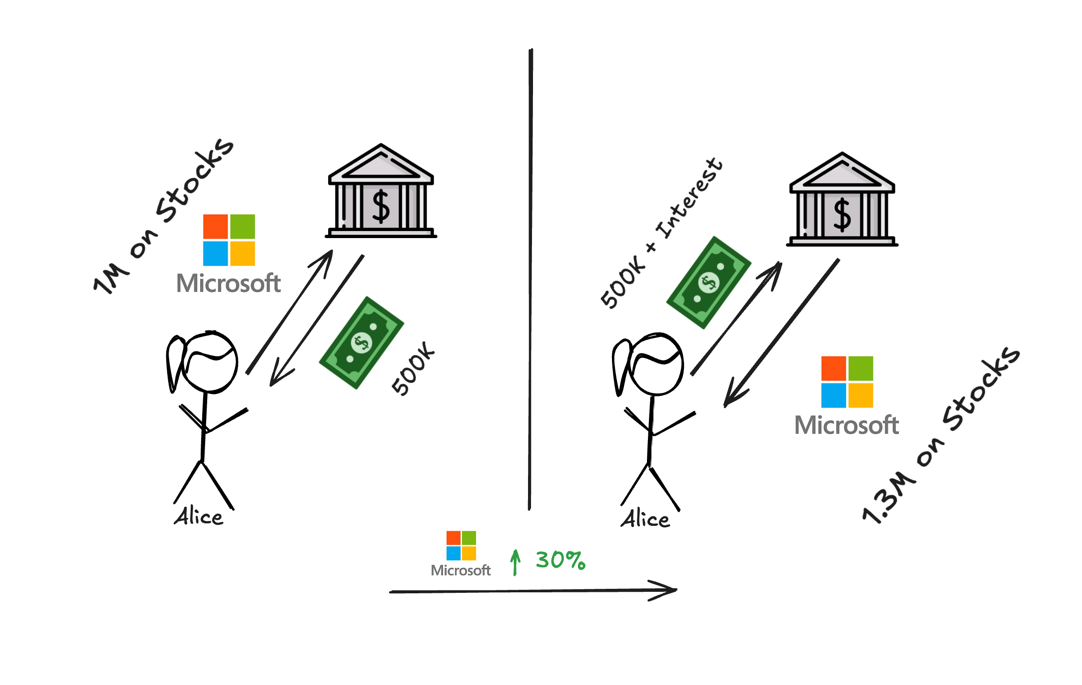

High-net-worth investors often leverage their appreciated stocks to secure low-interest loans. This provides liquidity for other investments or personal expenses while leaving their equities intact to capture further gains.

Step-by-Step Process in Traditional Finance

The journey from stock ownership to liquidity

1. Portfolio Review

A broker evaluates a $1M stock portfolio with blue-chip shares.

2. Loan Request

The investor requests a 50% LTV securities-backed line of credit for $500k.

3. Collateral Agreement

The lender holds the shares as collateral but the investor keeps dividends.

4. Deploy Capital

The borrowed funds go to real estate or business ventures.

5. Monitor Appreciation

Over 2 years the portfolio rises to $1.3M (14% annual growth).

6. Repay Loan

The investor repays the $500k plus 10% interest (5% annually) using profits while keeping the stocks.

7. Rebalance

If markets dip, extra shares or cash are added to maintain LTV.

Benefits of This Model

Liquidity Without Selling

Access cash for new opportunities while still owning the shares.

Tax Efficiency

Borrowing against stocks doesn't trigger capital gains.

Diversification

Use funds for other asset classes like real estate or startups.

Retain Market Upside

Stay invested as equities potentially appreciate.

Fast Access

Lines of credit can fund within days from major brokers.

Risks of This Model

Understanding the risks of stock-backed loans

Market Volatility

Falling prices can trigger margin calls—maintain a cushion.

Interest Costs

Rates are low but add up if markets stagnate.

Over-leverage

Large loans relative to portfolio can lead to forced liquidation.

Dividend Cuts

Lower dividends may affect repayment plans.

Tax Changes

Future regulations may reduce advantages.

Real-World Examples

A tech executive borrowed $500k against a $1M stock portfolio via Morgan Stanley. By 2025, the portfolio appreciated to $1.3M. He repaid the loan using business profits, keeping his stocks and capturing further gains. Similarly, Elon Musk has pledged over 238 million Tesla shares as collateral to secure personal loans—allowing him to access liquidity without selling equity. This strategy preserves ownership, voting power, and upside potential.

Unlock Liquidity Without Selling

Stock-backed loans let you access cash while retaining ownership and potential upside. They're particularly valuable for concentrated positions or when you want to defer capital gains taxes.

Explore PlatformsSupporting Quotes

Securities-based lines of credit offer investors liquidity while keeping their portfolios intact.

high

Borrowing against a portfolio lets you meet short-term cash needs without interrupting your investment strategy.

high

Using securities as collateral may provide a lower-cost alternative to personal loans or credit cards.

high

The rich use asset-backed lines of credit to avoid selling and to fund investments.

high

More Case Studies

Top Lending Platforms

Choose a provider and start borrowing today.

Some links are referrals that help support the site.