Introduction

Since its inception in 2009, Bitcoin has undergone a remarkable transformation from a niche technological experiment to a recognized asset class reshaping global finance[1]. Created by the pseudonymous Satoshi Nakamoto, Bitcoin emerged at a pivotal moment—the 2008 financial crisis had exposed the fragility of traditional banking systems and fiat-dependent economies[2]. What began as a payment protocol for a small community of cryptographers and tech enthusiasts has evolved through distinct phases, each adding new layers of utility and acceptance. Today, as institutional adoption accelerates and regulatory frameworks solidify, Bitcoin stands at the threshold of mainstream financial integration[3][4].

The journey of Bitcoin reflects broader societal concerns: the limitations of fiat currencies, persistent inflation, centralized control, and the search for alternative stores of value[5]. This evolution hasn't been linear. Instead, it has followed distinct phases, each driven by technological breakthroughs, regulatory developments, and shifting market perceptions. Understanding these phases provides insight into not just Bitcoin's history, but the future trajectory of digital finance.

Phase 1: The Exploratory Payment Tool (2009-2013)

Bitcoin's earliest phase was characterized by idealism and experimentation[1]. In January 2009, the Bitcoin network went live with Satoshi Nakamoto mining the genesis block, creating the first 50 bitcoins[6]. The network's early adopters were predominantly cypherpunks—technologically sophisticated individuals concerned with privacy, cryptography, and resistance to centralized authority[7]. These pioneers believed Bitcoin could serve as peer-to-peer electronic cash, enabling transactions without intermediaries[2].

During this period, Bitcoin had no market price. Early miners could accumulate coins with minimal effort using standard computers. The first recorded Bitcoin transaction occurred when Nakamoto sent 10 bitcoins to programmer Hal Finney, establishing the protocol's practical viability[1]. The community remained small and dedicated, discussing Bitcoin on forums and mailing lists, refining code, and testing the network's resilience.

A turning point came in 2010 when the first Bitcoin exchange, BitcoinMarket.com, facilitated the first recorded price discovery—Bitcoin traded at approximately $0.003[8]. By October 2010, a single bitcoin reached $0.10. This price discovery phase marked the transition from pure experiment to nascent market. The Silk Road marketplace (2011-2013) demonstrated Bitcoin's utility for commerce, though its association with illegal activities created the first regulatory concerns and public skepticism[7].

By 2013, Bitcoin had survived four years of skepticism and technical challenges. The network's consensus mechanism proved robust, and despite predictions of failure, adoption continued growing. However, the phase ended turbulently: the Mt. Gox exchange—which handled 70% of Bitcoin transactions at its peak—suffered a catastrophic hack in 2014, losing approximately 740,000 bitcoins[9]. This crisis tested the market's faith, but Bitcoin recovered within two years, eventually reaching new all-time highs[3].

Phase 2: The Speculative Asset (2013-2017)

Following price discovery, Bitcoin entered its speculative phase. Rather than serving exclusively as a payment mechanism, Bitcoin attracted traders and investors seeking capital appreciation[4]. The price volatility that made Bitcoin impractical for everyday transactions made it attractive to speculators.

In 2013 alone, Bitcoin's price surged from under $100 to nearly $1,000, capturing mainstream media attention[5]. The rally attracted retail investors and cryptocurrency enthusiasts, though the bubble collapsed dramatically, with prices falling approximately 80% in 2014-2015[9]. This pattern—explosive rallies followed by sharp corrections—became characteristic of Bitcoin's market behavior.

The period from 2015 to 2017 witnessed the emergence of institutional interest. Financial analysts began publishing research on Bitcoin, venture capitalists funded blockchain startups, and academic institutions launched cryptocurrency programs[10]. Media coverage intensified, and regulatory discussions began in earnest. Different countries adopted divergent approaches: some embraced cryptocurrency innovation, while others implemented restrictive policies[7].

The 2017 bull run was exceptional. Bitcoin reached $19,500 in December 2017, driven by retail FOMO (fear of missing out), growing business adoption, and the explosive popularity of Initial Coin Offerings (ICOs)[5]. This rally expanded Bitcoin's visibility but also highlighted its limitations as a payment system. Network congestion and high transaction fees made Bitcoin unsuitable for micropayments, forcing a philosophical debate within the community about Bitcoin's core purpose[8].

The 2018 crash followed predictably, with Bitcoin falling to $3,500—an 82% decline[9]. However, institutional investors who had been studying Bitcoin on the sidelines recognized the opportunity. This crash marked the transition to the next phase.

Phase 3: The Store of Value (2018-2024)

As Bitcoin demonstrated long-term survival despite repeated crashes, institutional investors and macroeconomic observers began reconsidering its utility. The narrative shifted: Bitcoin was increasingly viewed not as digital cash, but as "digital gold"—a scarce, decentralized store of value[4][11].

This reframing was accelerated by macroeconomic factors. Central banks worldwide engaged in quantitative easing, expanding money supplies dramatically[5]. In 2020, the COVID-19 pandemic prompted unprecedented fiscal stimulus, and inflation concerns grew. Simultaneously, interest rates fell toward zero, reducing real returns on traditional assets[3]. Bitcoin's fixed supply of 21 million coins presented an attractive alternative for investors concerned about currency devaluation[2].

Major institutional adoption milestones marked this phase[10]:

- 2020: MicroStrategy, a business intelligence company, began accumulating Bitcoin as a treasury reserve asset, eventually purchasing over $6 billion worth[4]. Other technology companies and financial firms followed.

- 2021: Bitcoin reached $69,000, driven by corporate treasury adoption, PayPal integration, and mainstream investor participation. Several Fortune 500 companies added Bitcoin to their balance sheets[10].

- 2023-2024: The regulatory landscape clarified further. In January 2024, the U.S. Securities and Exchange Commission approved spot Bitcoin Exchange-Traded Products (ETFs), a watershed moment[3][11]. For the first time, retail investors could gain direct Bitcoin exposure through traditional brokerage accounts without managing private keys or using cryptocurrency exchanges.

The spot ETF approval fundamentally changed Bitcoin's accessibility and legitimacy. By providing a regulated, familiar investment vehicle, ETFs bridged the gap between crypto innovation and traditional finance[3]. Asset managers such as iShares and others quickly launched Bitcoin funds, accumulating significant positions[10].

The store-of-value narrative also benefited from geopolitical tensions. Countries experiencing capital controls or currency instability increasingly viewed Bitcoin as a hedge. El Salvador made Bitcoin legal tender in 2021, though with mixed practical results[12]. The Bhutan government and other nations accumulated Bitcoin reserves[10].

By 2024, Bitcoin's correlation patterns had shifted. Research showed Bitcoin maintaining a -0.29 correlation with the U.S. dollar and +0.49 correlation with high-yield corporate bonds, indicating its maturation as a distinct asset class[3].

Phase 4: Bitcoin as Collateral (2024-Present)

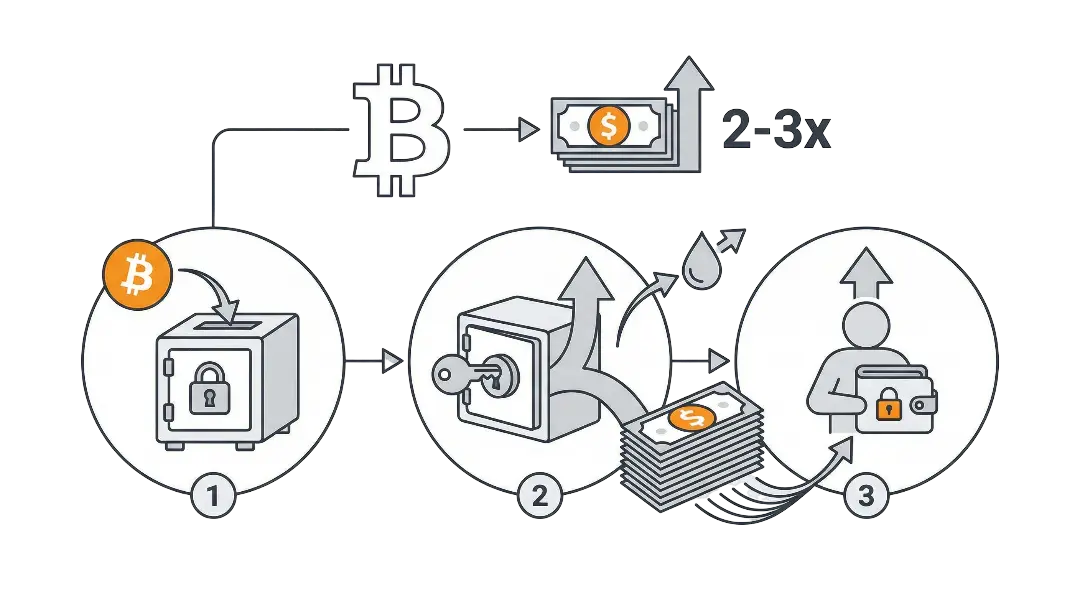

The newest phase reflects Bitcoin's integration into sophisticated financial infrastructure. Rather than simply holding Bitcoin as an end asset, financial institutions now use Bitcoin as collateral for borrowing, lending, and yield-generating activities[6][13].

Bitcoin collateralization existed previously in cryptocurrency derivatives markets, but institutional financial applications represent a new scale and legitimacy[13]. Financial institutions now lend against Bitcoin holdings, allowing borrowers to access liquidity while maintaining potential appreciation[6]. These loans typically operate with loan-to-value (LTV) ratios—borrowers can borrow 40-60% of their Bitcoin's value, depending on market conditions[6].

The mechanisms vary in sophistication[6]:

- Cold Storage Approach: Lenders hold Bitcoin in secure offline storage, protecting against theft while ensuring collateral availability.

- Rehypothecation: More complex arrangements where lenders leverage collateral further by lending it to other parties or using it for investment purposes[6]. While this generates additional returns for lenders (potentially reducing borrowing costs), it introduces counterparty risk for borrowers[6].

This collateral phase represents Bitcoin's evolution from speculative asset to operational financial infrastructure. It demonstrates the maturation of custody solutions, lending platforms, and regulatory frameworks[4][13]. Institutions including major banks, asset managers, and cryptocurrency lending platforms now offer Bitcoin-collateralized lending products.

2025 marks another acceleration point. President Trump's January 23, 2025 executive order mandated a comprehensive federal crypto framework within 180 days and rescinded Staff Accounting Bulletin 121 (SAB 121), which had previously blocked banks from holding customer crypto assets on their balance sheets[4]. This regulatory shift unlocks institutional banking participation in the crypto economy[4].

Industry forecasts predict an S-curve adoption pattern. Pension funds and 401(k) plans are expected to begin allocating 2-5% to Bitcoin ETFs from 2025-2027, establishing the foundation for broader institutional integration[4]. Corporate treasuries are anticipated to expand allocations through 2028-2030[4]. Bitcoin's trading patterns have also stabilized—2025 data shows lower volatility and trading volume compared to previous years, suggesting market maturation[3].

Conclusion

Bitcoin's 16-year journey reflects a fundamental rethinking of value, trust, and financial infrastructure. From cypherpunk experiment to global asset class, Bitcoin has demonstrated remarkable resilience through multiple boom-bust cycles, regulatory challenges, and technological evolution[1][3].

The four phases—exploratory payment tool, speculative asset, store of value, and collateral infrastructure—aren't sequential endpoints but overlapping expressions of Bitcoin's expanding utility. Bitcoin remains usable as a payment method, maintains speculative interest, serves as portfolio insurance, and now functions within institutional financial architecture[11].

What's most remarkable isn't any single use case, but Bitcoin's durability. Predictions of failure, regulatory prohibition, and technical obsolescence have repeatedly proven unfounded. Instead, Bitcoin has absorbed criticism, adapted to market demands, and integrated into legitimate financial structures[3][5].

As institutional adoption accelerates and regulatory frameworks solidify, Bitcoin transitions from outsider asset to embedded financial component. The observations documented today—Bitcoin gaining against fiat currencies, serving as collateral, and attracting institutional allocation—likely represent early stages of a decades-long structural shift in how humanity manages value across borders and generations[4][11].

The next chapters of Bitcoin's evolution will be written by institutions, regulators, and technologies not yet conceived. But the foundation has been established: Bitcoin has proven it isn't a bubble destined to vanish, but a persistent alternative to the fiat currency systems it was created to challenge.

References

[1] Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. https://bitcoin.org/bitcoin.pdf

[2] Wikipedia. (2025). History of bitcoin. Retrieved January 7, 2026, from https://en.wikipedia.org/wiki/History_of_bitcoin

[3] OANDA. (2026, January 4). Bitcoin's price history (2009 - 2025) – key events and insights. Retrieved January 7, 2026, from https://www.oanda.com/us-en/trade-tap-blog/asset-classes/crypto/oanda-bitcoin-price-history-key-market-events-data-charts-insights

[4] Datos Insights. (2025, July 27). Bitcoin institutional adoption: How U.S. regulatory clarity unlocks institutional investment. Retrieved January 7, 2026, from https://datos-insights.com/blog/bitcoin-etf-institutional-adoption/

[5] Bitcoin Magazine. (2025, October 16). Bitcoin price history: 2009 — 2025. Retrieved January 7, 2026, from https://bitcoinmagazine.com/guides/bitcoin-price-history

[6] Enness Global. (2024, December 12). Using Bitcoin as collateral for high-value lending: Key questions and considerations. Retrieved January 7, 2026, from https://www.ennessglobal.com/insights/blog/using-bitcoin-collateral-high-value-lending-key-questions-and-considerations

[7] Wikipedia. (2025). Bitcoin. Retrieved January 7, 2026, from https://en.wikipedia.org/wiki/Bitcoin

[8] KuCoin Research. (2024, December 26). Top crypto milestones and insights to know in the 2024-25 Bitcoin bull run. Retrieved January 7, 2026, from https://www.kucoin.com/research/insights/top-crypto-milestones-and-insights-to-know-in-the-2024-25-bitcoin-bull-run

[9] 101 Blockchains. (2025, October 15). Institutional adoption of Bitcoin: Driving the next bull run? Retrieved January 7, 2026, from https://101blockchains.com/institutional-adoption-of-bitcoin/

[10] Grayscale. (2025, December 14). 2026 digital asset outlook: Dawn of the institutional era. Retrieved January 7, 2026, from https://research.grayscale.com/reports/2026-digital-asset-outlook-dawn-of-the-institutional-era

[11] CME Group. (2025, January 9). Celebrating Bitcoin's 16th birthday: A look at achievements in the crypto space. Retrieved January 7, 2026, from https://www.cmegroup.com/articles/2025/celebrating-bitcoins-16th-birthday-a-look-at-achievements-in-the-crypto-space.html

[12] B2Broker. (2025, December 8). Institutional adoption of cryptocurrency: 2025-2026 market analysis. Retrieved January 7, 2026, from https://b2broker.com/news/institutional-adoption-of-crypto/

[13] CoinDesk. (n.d.). Banking on Bitcoin: BTC as collateral. Retrieved January 7, 2026, from https://downloads.coindesk.com/research/TheStateofBitcoinasCollateral.pdf