Case Study: Using Bitcoin-Backed Loans to Acquire Stablecoins (DAI)

Introduction

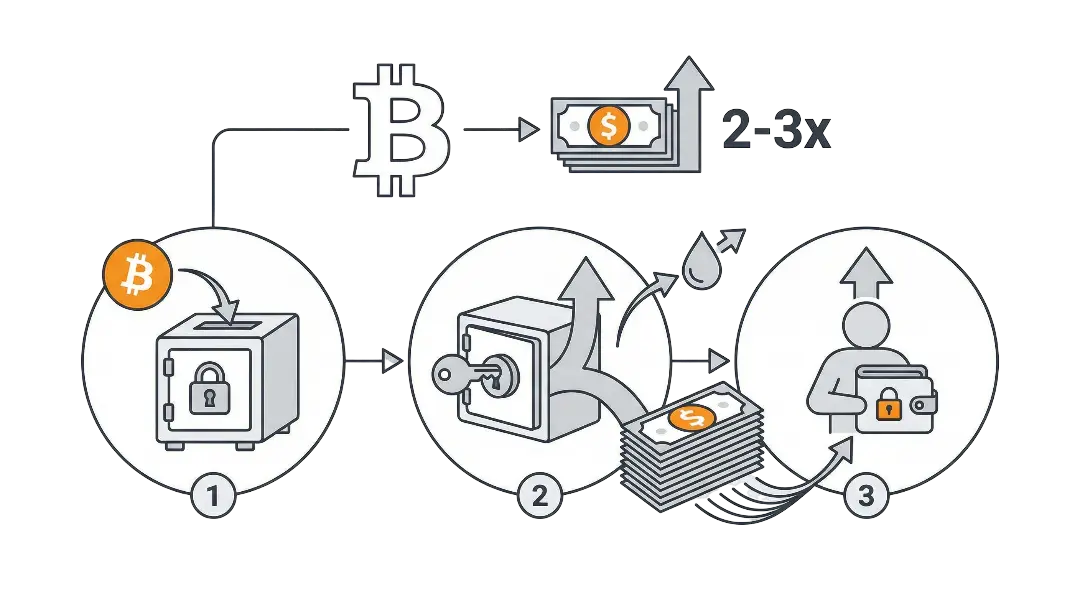

One of the most common challenges for Bitcoin holders is how to access liquidity without selling their BTC. In times of volatility, borrowing against Bitcoin to obtain stablecoins like DAI can provide immediate purchasing power while preserving long-term upside. DAI is a decentralized, collateral-backed stablecoin that maintains a soft peg to the U.S. dollar, allowing borrowers to cover expenses or make investments without exposure to fiat banking restrictions.

By using a Bitcoin-collateralized loan to mint or acquire DAI, borrowers gain stability in the short term and retain exposure to Bitcoin’s long-term appreciation. In this way, the loan can effectively “pay for itself” if Bitcoin’s price rises while the debt remains denominated in a dollar-pegged unit.

Risks and Mitigations

1. Collateral volatility

Risk: If Bitcoin’s price falls, collateral value shrinks, potentially triggering liquidation.

Mitigation: Use conservative loan-to-value ratios (LTV), set up automated alerts, and maintain additional BTC reserves that can be posted quickly.

2. Stablecoin de-peg

Risk: Although DAI is designed to maintain parity with USD, extreme market conditions can cause temporary deviation.

Mitigation: Diversify by holding multiple stablecoins or convert DAI to fiat quickly if needed. Keep loan terms flexible enough to roll into alternative assets.

3. Smart contract or platform risk

Risk: If using MakerDAO or a CeFi/CeDeFi platform that wraps BTC into DAI loans, smart contract bugs or custodial failures could jeopardize funds.

Mitigation: Prefer audited protocols, self-custodial bridges, or reputable lenders. Spread exposure across platforms rather than concentrating in one.

4. Interest rate fluctuations

Risk: Borrowing cost in DAI may vary depending on stability fees or protocol governance.

Mitigation: Fix rates when possible, monitor governance decisions, and repay early if rates spike.

Why This Works

- Preserves Bitcoin upside: The borrower never sells their BTC, keeping exposure to long-term appreciation.

- Access to liquidity: Immediate spending power in a stable medium (DAI), suitable for bills, business expenses, or other dollar-denominated commitments.

- Self-repaying potential: If Bitcoin appreciates faster than the loan accrues interest, the dollar value of the collateral grows relative to the debt. Over time, a portion of that growth can offset or fully cover the loan cost.

- Decentralized stability: DAI, unlike centralized stablecoins, is collateralized and governed by a decentralized system, aligning with Bitcoiners’ preference for censorship resistance.

Example Scenario

- A borrower deposits $20,000 worth of BTC into a collateralized loan.

- They borrow $5,000 worth of DAI at a 25% LTV.

- Over 2 years, BTC doubles in value to $40,000.

- The debt in DAI remains $5,000 (+ interest), but the collateral now covers it at only ~12.5% LTV.

- The borrower can repay easily, reclaim their BTC, and effectively the appreciation in Bitcoin paid for the original liquidity.

👉 This case highlights how Bitcoin-backed loans denominated in stablecoins like DAI create short-term stability and long-term growth alignment.